Medigap Plan C

What is Medigap Part C and what benefits does it offer?

Medicare Supplement Plan Part C is healthcare insurance coverage offered by private insurance companies in the United States to cover gaps left by Original Medicare plans.

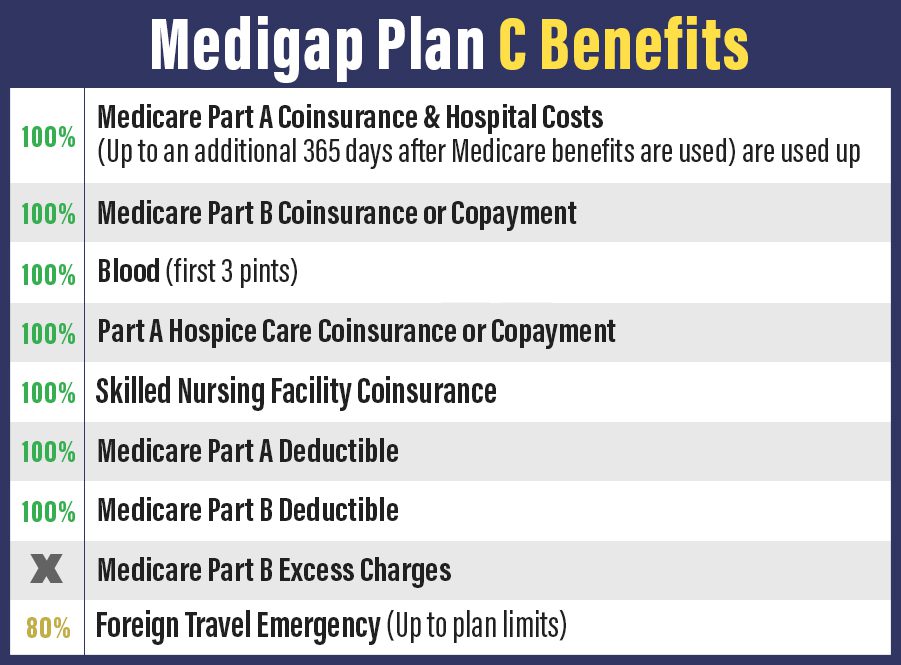

It offers the following benefits:

- Medicare Part A hospital and coinsurance expenses for up to an additional 365 days after your Medicare benefits are exhausted.

- Medicare Part A hospice care coinsurance and copayments.

- Medicare Part A and Part B deductibles

- Medicare Part B copayments or coinsurances

- The first three pints of blood during medical procedures

- Skilled nursing healthcare facility coinsurance

- Foreign travel healthcare emergency coverage of up to 80%

It does not, however, cover Medicare Part B excess costs.

How does Medigap Part C work and how do I enroll?

Medigap Part C covers surcharges from your Original Medicare costs. To be eligible for enrolment, you need to be a Medicare Part B beneficiary.

Your initial Medigap enrolment period lasts six months after you enroll into Medicare Part B and during this period, your Medigap premiums remain constant. Once your initial enrolment period window closes, you can still get Medigap coverage at any time but you are not guaranteed stable premiums.

To help you choose your Medigap Supplementary Plan with confidence, our Medicare insurance agent is always happy to help and answer all your questions about your Medicare plans.